Students react to Biden’s loan forgiveness plan

Canva Image made by Asyah Zamani

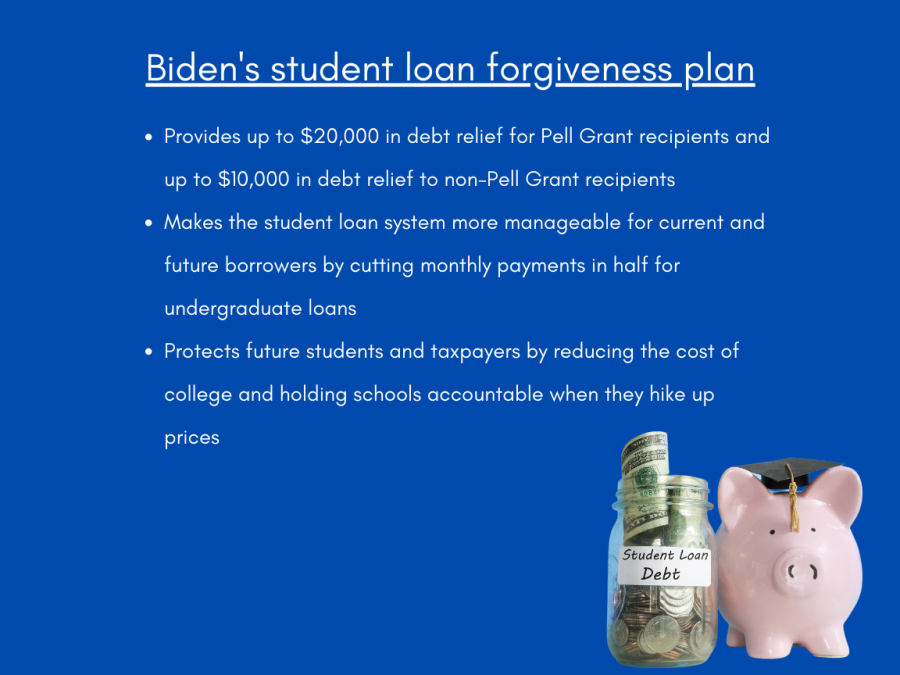

President Joe Biden announces a loan forgiveness plan for college students. Some Cosumnes River College students were for the plan while others had mixed feelings about it.

President Joe Biden announced a new student loan forgiveness plan on Aug. 24 and now Cosumnes River College students are thinking about what it means for them.

The 3-part plan will provide up to $20,000 in debt relief for Pell Grant Recipients and up to $10,000 in relief for non-Pell Grant recipients. Borrowers are eligible if their annual income does not exceed $125,000 for individuals and $250,000 for households.

Ten CRC students were interviewed for their feelings about the plan, how they thought it would affect future college students and their own experiences with student loans.

Eighteen-year-old Sebastian Recinos, a kinesiology major, said he thinks the plan will help out lower income families.

“I think this plan definitely helps out those lower income families because it allows for more opportunities for the students to have their education, to have their aspirations achieved,” Recinos said.

Forty-two percent of students who dropped out of college did so due to financial reasons, according to the Education Data Initiative, an organizaion of researchers who compile and analyze statistics on education from both academic and federal sources.

The Department of Education estimates that almost 90% of the relief funds will be going towards individuals and households earning under $75,000 a year.

Allied health major Angelo Torricer, 18, said he thinks that the loan will give more students the opportunity to attend college.

“It’ll make it easier for students to pay off their college tuition and other stuff like that, so there’ll be more students having that resource available to them,” Torricer said.

Other students had mixed feelings about the plan due to their own experiences with student loans.

Victoria Chau, a 24-year-old art major, said her family’s view of loans has shaped her own view.

“I’m a first-generation student, my parents are both immigrants. I have always been told not to take loans because loans are a death trap,” Chau said.

Edgar Rubalcaba, a 23-year-old botany major and first-generation student, said he struggled with money while he was serving overseas in the military.

“Because I was gone away for so long, the school recently just charged me $3,000 for my classes. I had to actually argue about whether or not I was a resident of California,” Rubalcaba said.

Eighteen-year-old Emma Withrow, a psychology major, can see both sides of the issue.

“I feel like it’s really hard because some people are really struggling and they could really use the money, but I also feel like they decided to go into those student loans, so it shouldn’t just be forgiven,” Withrow said.

Withrow said she supports the plan cutting the forgiveness time from 20 years to 10 years for borrowers with an initial loan balance of $12,000 or less.

The pause on student loan payments has been extended to Dec. 31 and more information on the loan plan will be released soon, according to the Biden Administration.